Last Month in the Markets: March 1st – 29th, 2024

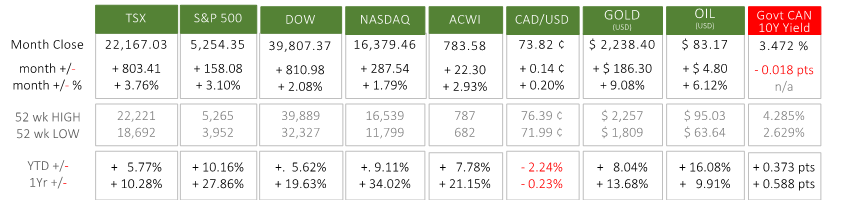

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

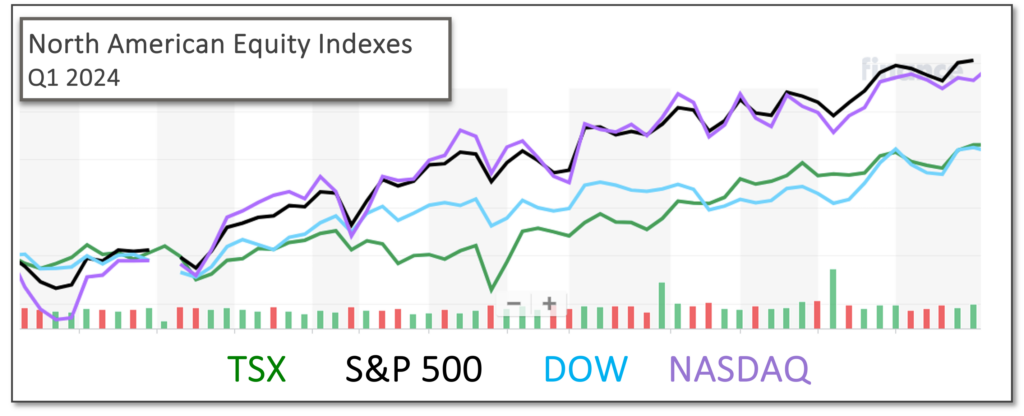

What happened in Q1?

Despite its 31-day length, the observance of Good Friday, had the 2024 version of March with just 20 trading days in Toronto and New York. Additionally, the first quarter (Q1) effectively concluded at end of day on March 28th. In 2025, Good Friday, will fall on April 18th, three weeks later than this year.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

The performance for Q1 is reflected as “YTD +/-“ in the grid above, since the first quarter aligns with Year-to-Date. North American equity indexes continued their performance by gaining 5½ to 10 percent in Q1. The positivity of the themes and influences for equities have continued throughout the quarter:

- Interest rate increases and tighter monetary policy that began in March 2022 have tempered inflation and is moving it back toward the 2% goal desired by the Bank of Canada, Federal Reserve and European Central Bank.

- High expectations that interest rates will be lowered by central banks this summer.

- A soft landing, where inflation is tamed and a recession is avoided.

- Employment will continue its strength despite tighter monetary policy over the last 2 years.

The strong performance extends beyond North America as global equities, represented by the All-Country World Index (ACWI), have delivered nearly 8 percent for Q1, and includes 23 developed markets and 24 emerging markets.

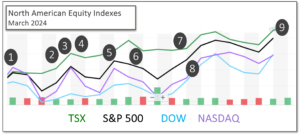

What happened in March?

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Several announcements contributed to the 2 to 4 percent rise in equity indexes last month:

- March 1st

The month began positively for equity investors after the Bureau of Economic Analysis released the Federal Reserve’s preferred inflation indicator and the Personal Consumption Expenditures (PCE) price index. Inflation for January broadly met expectations, and the lack of upside surprise made little news, and the major indexes continued their upward trajectory. As the month began the Dow, S&P 500 and NASDAQ had gained 20%, 30% and 40% over the past year. BEA PCE release

- March 6th

In widely expected news on Wednesday, the Bank of Canada held its policy interest rate unchanged. The overnight rate remains at 5%, the Bank Rate is 5¼%, and the deposit rate is 5%. In January, the Canadian Consumer Price Index (CPI) was 2.9%. “The Bank continues to expect inflation to remain close to 3% during the first half of this year before gradually easing”. Tiff Macklem, Bank of Canada Governor stated, “We don’t want inflation to get stuck, materially, above our target.” BoC release CBC and BoC

- March 7th

the European Central Bank (ECB) mirrored the Bank of Canada’s decision to keep policy interest rates unchanged. ECB staff project projects “inflation to average 2.3% in 2024, fall to 2.0% in 2025 and again to 1.9% in 2026.” ECB release

- March 8th

February’s 275,000 additional jobs is above the average monthly gain of 230,000 over that last year, according to the Bureau of Labor Statistics. Job gains were concentrated in health care, government and food services and drinking places, social assistance and transportation, and warehousing. The unemployment rate rose 0.2% to 3.9% as 334,000 more job seekers were unsuccessful and totalled 6.5 million, up by 500,000 over February 2023. BLS release CNBC and jobs

- March 12th

The Bureau of Labor Statistics reported that the U.S. Consumer Price Index rose 0.4% in February, up from January’s 0.3% rise. On a year-over-year basis, consumer prices have risen 3.2%. Shelter and gasoline contributed more than 60% of February’s one-month price inflation. BLS CPI release

- March 14th

The Producer Price Index (PPI) for final demand rose 0.6% in February after increasing 0.3% in January and decreasing 0.1% in December. On an unadjusted basis, the final demand index rose 1.6% over the past year, which is the largest increase since September 2023 when the PPI rose 1.8%. Much of the increase can be traced to the rise of the price of gasoline. BLS PPI release

- March 19th

Domestically, Canadian consumer inflation continues to moderate as the Consumer Price Index (CPI) rose 2.8% on a year-over-year basis in February, down from 2.9% in January. Groceries contributed to the small decline, while gasoline prices offset the dip after rising 0.8% for the month. The on-going slowing of inflation is positive news for consumers and, eventually, borrowers since interest rates were raised to temper and reduce price increases. The Bank of Canada has not indicated the timing of rate reductions. StatsCan release CBC and BoC

- March 20th

Two weeks after the Bank of Canada made its monetary policy announcement, the Federal Reserve also kept its rates unchanged. The Fed released its quarterly Summary of Economic Projections (SEP) that indicate interest rates are expected to be lowered in 2024, 2025 and 2026. Fed release, SEP, and press conf

January’s Labour Force Survey (LFS) from StatsCan showed that employment increased by 37,000 following three months with little change in total jobs. The unemployment rate fell 0.1% to 5.7%; the first decline in more than one year. StatsCan release CBC and LFS

- March 29th

Core PCE, which excludes food and energy, sits at 2.8% year-over-year for February. Annualized inflation is unchanged since last month and is at its lowest level in nearly three years. The long-term goal of the Federal Reserve is an average of 2% for core PCE, but it has been more than three years since inflation levels were at target levels. The Fed’s next interest rate announcement will occur on May 1st, when rates are expected to be held unchanged again. The earliest date that an interest rate reduction is anticipated is June 12th according to CME’s FedWatch tool. BEA’s PCE release CNBC and PCE.

What’s ahead for April and beyond?

As we emerge from almost two years of elevated inflation, the path of monetary policy continues to heavily influence capital markets for the near future. Currently, interest rates are restricting economic growth by slowing demand, and thereby lowering demand-driven price inflation.

One of the major concerns in Canada is that reducing interest rates too soon could overheat the spring housing market, and further raise and extend on-going inflation. Additionally, inflation and its predictability have not reached levels to facilitate a rate cut, and we will be heavily influenced by U.S. monetary policy that also does not predict a rate cut until June or July. CME FedWatch tool CBC and BoC rates BoC press conf excerpt BoC and housing